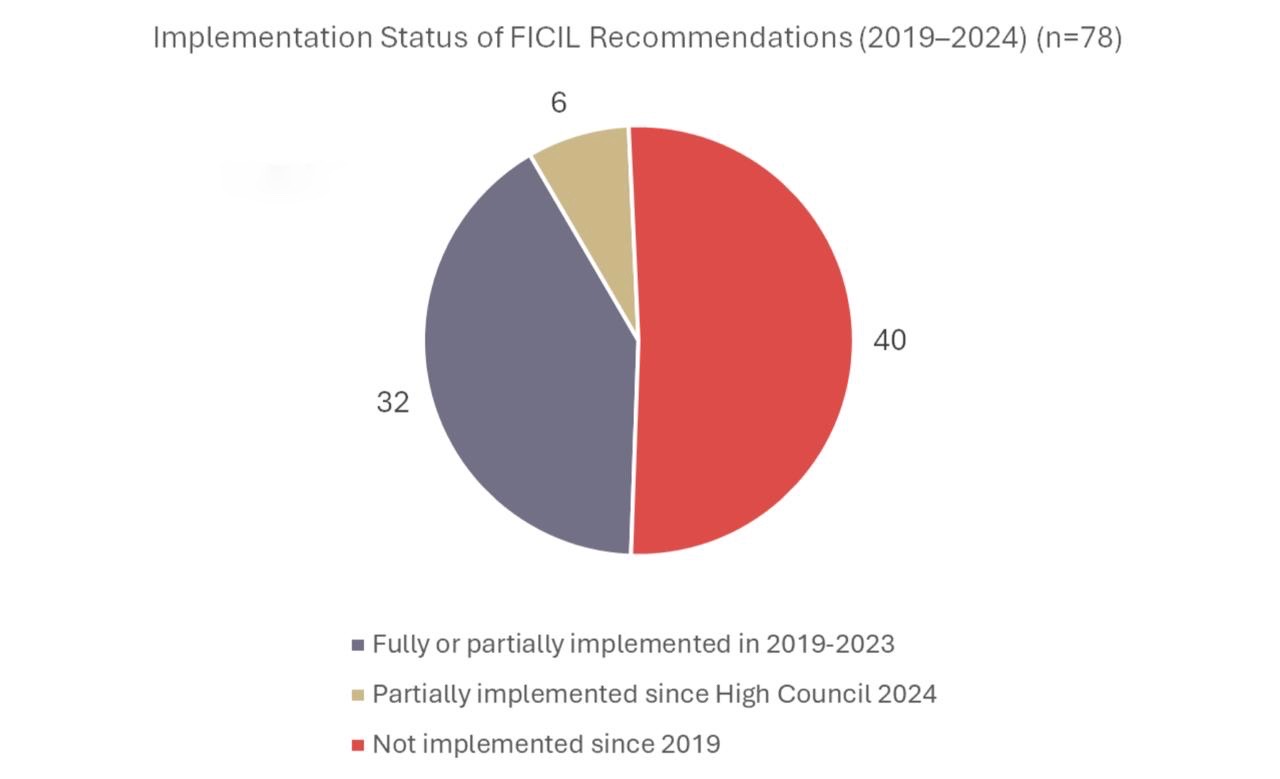

FICIL’s Shadow Economy Combatting Work Group has consistently focused on promoting greater fairness and transparency of Latvia’s investment climate, stimulated a tax-compliant behaviour and effectivization of tax administration. Since 2019, the group has put forward 78 recommendations. To date, 49% of all recommendations — 38 in total — have been fully or partially implemented. Since the previous High Council in 2024, measurable progress has been recorded on 6 recommendations, 4 of which were included in the 2024 position paper.

Specifically, efforts have been made to strengthen prosecutorial responsibility in complex investigations, to enhance the effectiveness of anti–money laundering measures, and to improve technological solutions that support data exchange between investigative institutions. The State Revenue Service (SRS) has advanced implementation of several FICIL recommendations by improving its own effectiveness, operational capacity and transparency, as well as, by supporting the broader shadow economy reduction agenda, reflected in the “Shadow Economy Reduction Plan 2024–2027”.

FICIL is grateful to the Latvian government and, specifically, to the State Revenue Service for collaboration and progress made since September 2024. However, it is critical to point to the slow implementation of the “Shadow Economy Reduction Plan 2024–2027”, which provides a structured framework for combatting the shadow economy, strengthening tax administration and compliance. The recent developments, such as postponing of the amendment adoption to Cabinet of Ministers Regulation No. 550 “Regulations on the procedure and content of suspicious transaction reports and threshold declarations”, signal a lack of political commitment to combat the shadow economy. This reinforces a persistent challenge: while strategic plans are being developed, decisive implementation remains limited.

Evita Goša: “The Shadow Economy Reduction Plan has been launched, but we’re still waiting to see it truly come to life. A plan alone doesn’t move the needle — what matters is coordinated action and the political will to deliver results. At the moment, progress is happening in small steps, when what’s needed is decisive movement.”

Ilze Berga: “There’s visible movement within the State Revenue Service and some willingness to cooperate more openly with the private sector. But progress is uneven and too slow. Without stronger follow-through and real accountability, the potential of these efforts will remain untapped.”

Vita Sakne: “Latvia’s tax policy continues to lag behind the evolving needs of the economy. Businesses require clarity and predictability, yet important changes are postponed. If the aim is to create a fairer system and reduce the shadow economy, then a more consistent and timely implementation of shadow economy plan are essential.”